2025 Hong Kong Offshore Exemption New Regulations Compliance Guide: Tax-saving Logic, Application Requirements and Full Process Practical Operations

On October 13th, Amazon issued a notice regarding "tax information reporting", clearly stating that it will submit the identities and income information of Chinese sellers to the Chinese tax authorities on a quarterly basis. The first submission will be completed by October 31st, and the data will cover transactions from July to September 2025.

I. New Regulation Interpretation: Amazon's Tax Information Reporting Guidelines

In fact, this transformation had already shown signs of occurrence.

In June 2025, the State Taxation Administration officially issued the "Announcement on Matters Concerning the Submission of Tax-related Information by Internet Platform Enterprises" (No. 15 of 2025), explicitly extending the obligation to submit tax-related information to all overseas internet platforms that serve Chinese businesses. This announcement, together with the new regulations issued on October 13 of this period, jointly form a complete regulatory framework.

The core points of the new regulation are quite clear: Any platform enterprises that have investment promotion activities in China, have a team, and have a company need to submit data to the Chinese tax authority.

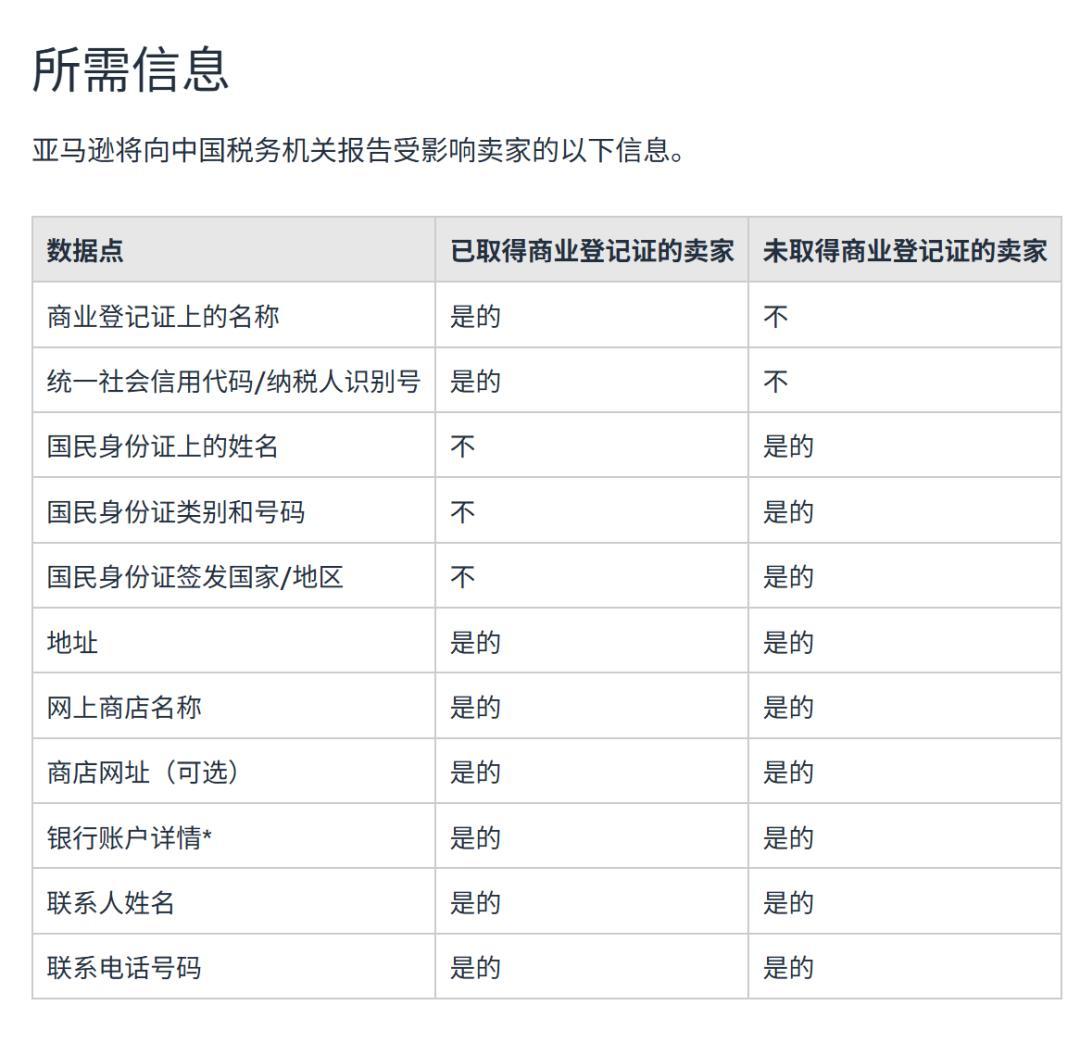

The submitted content includes: enterprise/personal name, unified social credit code or ID number, store ID and other identity information, as well as quarterly total sales amount (without commission deduction), refund amount, net income and other income information.

The tax regulation for cross-border e-commerce is undergoing fundamental changes. Following Amazon, multiple cross-border platforms such as Walmart and SHEIN have also issued similar notifications. A wave of tax compliance covering the entire industry is inevitable.

In response to this change, many sellers have begun to take action, changing the main ownership of their stores from companies based in the Chinese mainland to companies based in Hong Kong, in order to adapt to the new tax compliance environment.

II. Countermeasures: The advantages of Hong Kong companies are prominently displayed

Hong Kong companies have become the common choice for many sellers, and their unique advantages have become even more prominent in the new era.

1.The tax system is simple and transparent.

The tax system in Hong Kong is renowned for its simplicity, transparency and low cost. Hong Kong has only three direct taxes (income tax, salary tax, property tax), and there are no restrictions on foreign shareholders' shareholdings. The restrictions on the business scope of companies are also very few.

Hong Kong adopts a two-tier profit tax system: the tax rate for the first 200,000 yuan of profits is 8.25%, and for any profits exceeding 200,000 yuan, it is 16.5%. Moreover, Hong Kong implements the "source of income principle", meaning that only profits generated or derived in Hong Kong are subject to taxation, and overseas income is not taxable.

2. Free fund flow: Suitable for multi-site operations

As an international financial center, Hong Kong has no foreign exchange control, allowing free flow of funds in and out. This greatly facilitates the global business operations of cross-border e-commerce. In contrast, mainland enterprises are subject to foreign exchange control, with the annual foreign exchange settlement limit for individuals being 50,000 US dollars. Excess amounts require submission of tax payment certificates and trade contracts, making the process more complicated.

3. Better international image

Using a Hong Kong company as the business entity helps to build an international brand image and is more likely to gain the trust of overseas customers. It is also more convenient for Hong Kong companies to sign up for international payment tools such as PayPal/Stripe, with a relatively lower default payment rate, which helps to increase the transaction success rate.

4. Address tax transparency

In the context of Amazon submitting data to the Chinese tax authorities, using a Hong Kong company as the business entity can help reduce the overall tax burden through compliant tax planning. The audit report completed by the Hong Kong company can demonstrate the company's strong financial strength in the past, attracting more investors.

III. Switching the Main Character: Practical Guide for Changing the Amazon Store

To change the main entity of an Amazon store from a mainland company to a Hong Kong company, it is necessary to follow the formal procedures to avoid account risks.

1.Register a Hong Kong company

First, you need to register a Hong Kong company and prepare all the necessary Hong Kong company documents, including: company registration certificate, business registration certificate, identity certificates of directors and shareholders, company address proof, etc.

2. By means of official channels

Do not directly modify the store address in the backend. This may be regarded as fraudulent behavior by the system, which could result in the closure of the store.

The correct approach is as follows: First, contact the platform's customer service and inform them that you are undergoing a change of the company's main body. Then, submit the application through the official support channels and request the update of the company's information.

3. Ensure a smooth transition

Before changing the entity, it is recommended to open a Hong Kong bank account in advance to ensure that the receipt process is not affected. At the same time, it is necessary to reasonably arrange the transition period between the old and new entities to avoid any impact on normal operations. It is suggested to carry out the operation during the off-season for sales to minimize the risk of the change.

IV. Compliance Operations: Key Points for Hong Kong Companies

Registering and opening an account for a Hong Kong company is just the first step. The subsequent compliance maintenance is equally important. Hong Kong companies are required to undergo annual reviews and audits each year to ensure legal and compliant operations.

1.Annual Audit of Hong Kong Company

The annual review mainly involves updating the basic information of the company with the company registration office to ensure that the company continues to meet the registration requirements. This is a necessary condition for maintaining the legal existence of the company.

2. Audit of Hong Kong Company

Auditing is conducted by licensed accountants in Hong Kong to review the company's financial statements, aiming to accurately reflect the company's financial status and operating results. According to Hong Kong Company Law, Hong Kong companies are required to conduct an annual audit for tax purposes. Even if there is no operation, an operation-free audit report is necessary, and a simple zero-reporting of profit and loss statements is not allowed.

For the first time, a Hong Kong company needs to conduct an accounting audit 18 months after its establishment. The profit tax return must be submitted before the specified date. Generally, March 31st or December 31st can be chosen as the fiscal year end.

With the advancement of global tax transparency, the cross-border e-commerce industry is moving from unregulated growth to maturity and standardization. In this transformation, those who take the initiative to comply will win the future, and Hong Kong companies undoubtedly become one of their most reliable allies.

We are a licensed secretary company in Hong Kong, specializing in providing one-stop services for Hong Kong company registration, account opening, annual review, auditing and tax filing. If you need to handle "Hong Kong company registration + account opening", or if you want to know the specific policies, you can contact us via the phone number below or add our WeChat account for detailed communication.