2025 Hong Kong Offshore Exemption New Regulations Compliance Guide: Tax-saving Logic, Application Requirements and Full Process Practical Operations

1、 Core concept analysis: What are the three aspects of accounting, auditing, and tax reporting for Hong Kong companies?

Bookkeeping

- What is it: The process of organizing and recording all original vouchers such as bank statements, contracts, invoices, receipts, expense statements, etc. based on the daily business activities of the company, and preparing standardized financial statements (such as balance sheets, income statements). This is the most basic job.

- Who will do it: usually done by internal accounting personnel or outsourced to professional accounting firms.

Audit (Audit)

- What is it: Independent review and verification of a company's financial statements by a certified public accountant (CPA) in Hong Kong to ensure their truthfulness, fairness, and compliance with the Hong Kong Companies Ordinance and Hong Kong Accounting Standards (HKFRS). Finally, issue a legally binding audit report.

- Who will do it: It must be conducted by a third-party independent auditor (accounting firm) registered with the Hong Kong Institute of Certified Public Accountants and the Financial Reporting Council. Internal personnel of the company cannot audit themselves.

Tax Filing

- What is it: The legal procedure for reporting a company's financial condition and payable taxes (mainly profits tax) to the Hong Kong Inland Revenue Department (IRD). Audit reports and completed tax forms must be submitted when filing taxes.

- Who will do it: Usually assisted by auditors or secretarial companies, it is ultimately signed and confirmed by the company's directors before being submitted to the tax bureau.

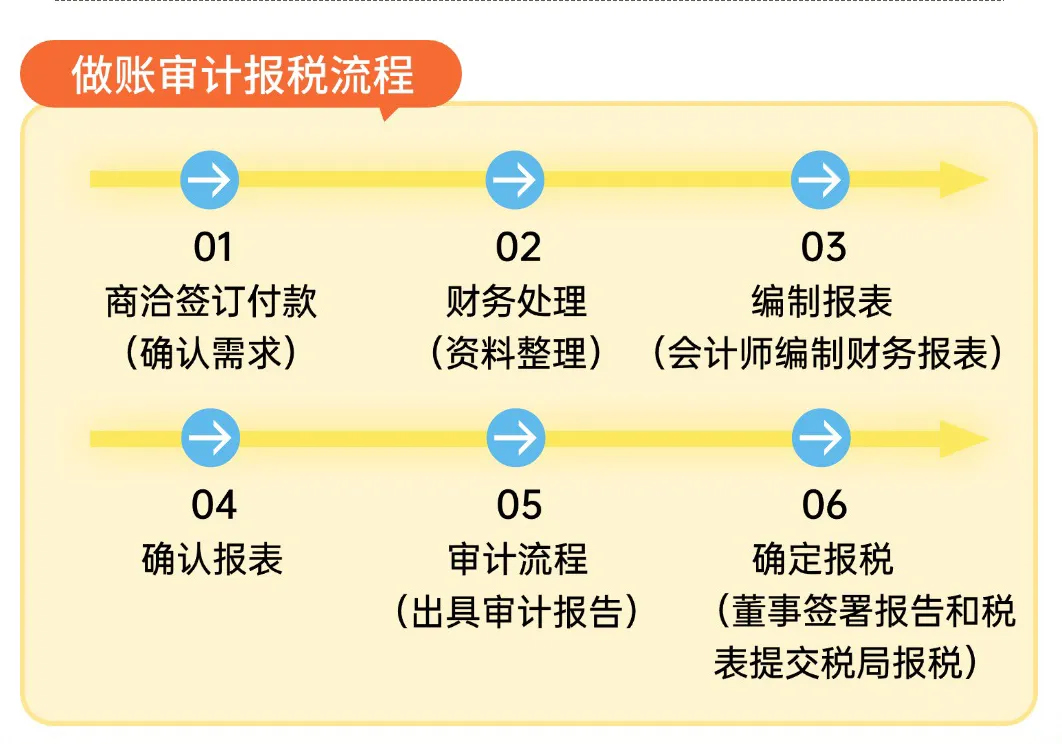

2、 The relationship between accounting, auditing, and tax reporting of Hong Kong companies: a closely connected process

You can understand it as a "progressive and indivisible" process:Bookkeeping → Audit → Tax Reporting

- Bookkeeping is the foundation: without accurate and complete accounts, auditing cannot be discussed. The financial statements generated from bookkeeping are the direct object of audit.

- Audit is the core and bridge: auditors verify financial statements and issue audit reports. This report is an essential document for tax reporting, which proves the credibility of the company's accounts to the tax bureau.

- Tax reporting is a result and obligation: calculate the tax payable based on audited financial statements and submit it to the tax bureau along with the audit report to fulfill the company's legal obligations.

Simple metaphor:

- Bookkeeping is like preparing ingredients and cooking.

- Audit is like inviting a foodie (third-party) to taste and issue an appraisal report to prove that the food is qualified.

- Taxation is like paying food expenses to the administrator based on this appraisal report and the final value of the food.

Important Notice:

- No audit, no tax reporting: Except in rare cases (such as "dormant companies"), Hong Kong companies must attach an audit report when filing taxes. Attempting to file taxes directly using unaudited financial statements is illegal.

- Audit relies on bookkeeping: If the company's accounts are chaotic and the vouchers are incomplete, the auditor will not be able to issue an "unqualified opinion" clean report, and may even refuse to accept the commission, resulting in tax delays and fines.

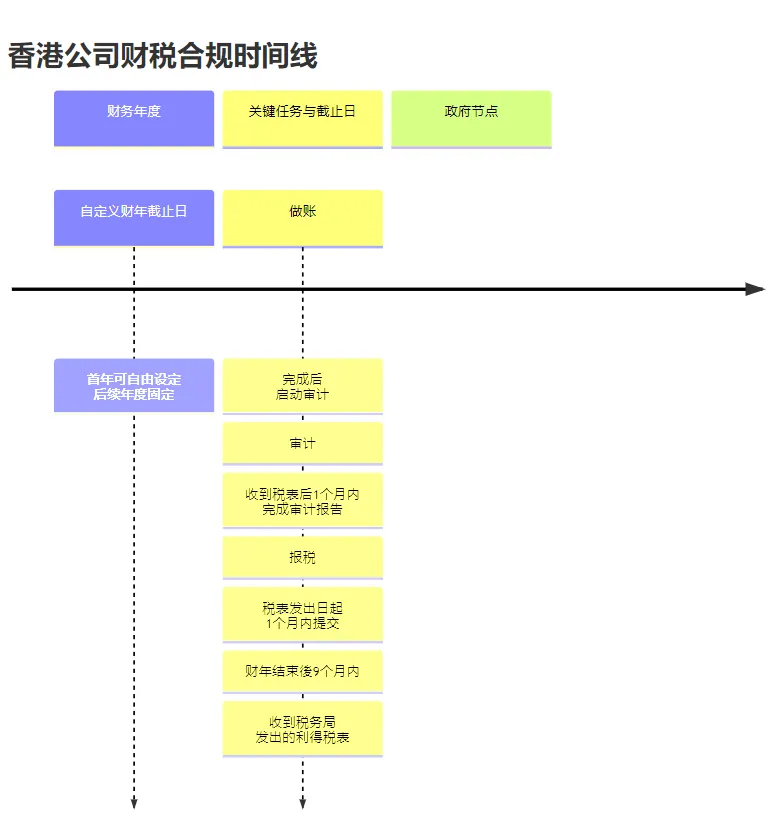

3、 Timeline sorting: key deadlines

The financial cycle of Hong Kong companies is crucial, and the following figure clearly shows the key time nodes and deadlines in this process:Detailed explanation of the above timeline:

Financial Year:

- The company can freely choose its financial year-end (usually choosing March 31 or December 31 to connect with the mainland's fiscal year), with a maximum of 18 months in the first year, but each subsequent fiscal year is generally 12 months.

- First tax filing deadline: For newly established Hong Kong companies, the deadline for first tax filing may vary depending on the date of establishment. The tax bureau usually issues the first tax form about 18 months after the establishment of your company.

Time for accounting audit:

- In theory, preparation for bookkeeping and auditing work can begin after the company's year-end closing date.

- Strong recommendation: Do not wait until you receive the tax form to start! It is advisable to prepare as early as possible, usually within 3-6 months after the year-end, to complete accounting and auditing work for the most secure time, and to reserve sufficient time for tax reporting.

After receiving the tax form:

- After the tax bureau issues the profits tax return, it is usually necessary to complete and submit it within one month (note: previously it was three months, but now the tax bureau only gives one month, subject to the deadline printed on the tax form).

- If unable to submit on time, an extension must be applied for before the deadline.

4、 Extension application strategy

By entrusting a professional accountant, it is usually possible to apply for an extension in submitting tax returns. The common delay strategies are as follows:

| Annual closing date of the company |

Usually extendable deadline |

| December 31 | August 15th of the following year |

|

March 31st |

November 15th of the following year |

| Other dates |

Usually postponed to April 15th of the following year |

Please note:

- The application for extension of submission is only for the tax return, but the payment of the payable tax will not be delayed due to the extension. The tax still needs to be paid before the originally scheduled payment date on the tax form.

- Bookkeeping, auditing, and tax reporting are legal obligations of Hong Kong companies, which must be handled regardless of whether the company is operating or not. No business can apply for exemption from tax reporting, but accounting and auditing are usually still required (unless it meets the conditions of a 'dormant company').

- Leave professional matters to professionals: It is recommended to entrust a professional Hong Kong accounting firm or secretarial company to handle the entire set of matters. They can ensure compliance, efficiency, and help you plan taxes and apply for extensions reasonably, avoiding high fines and even legal risks due to overdue payments. If you need consultation, please scan the code to add a professional consultant.

Shengsen International Business, founded in 2012, has a dual headquarters in Hong Kong and Shenzhen as its hub. With over 10 years of experience in cross-border business services, it relies on officially recognized compliance qualifications (including Hong Kong secretary licenses) and the resources of accounting and law firm alliances to build a global service network and collaborate deeply with international banks in multiple locations.

From business registration to financial and tax auditing, from legal support to secretarial services, professional qualification endorsement ensures that every service has rules to follow, building a global compliance defense line for overseas enterprises.