2025 Hong Kong Offshore Exemption New Regulations Compliance Guide: Tax-saving Logic, Application Requirements and Full Process Practical Operations

After the implementation of the Hong Kong Monetary Authority's "Revised Guidelines on Anti-Money Laundering and Counter-Terrorist Financing" in 2025, banks' verification standards for "business authenticity" and "fund legality" have become stricter: from the purpose of a single transfer of HK $50,000 to the compliance of the counterparty's region, clear responses and supporting documents are required.

Today, I have compiled 10 frequently asked anti-money laundering questions when opening a bank account in Hong Kong. Each question is accompanied by scenario-based response templates such as "cross-border e-commerce/traditional trade/new companies". The full text is quite long, and all data and processes are based on the review standards of mainstream banks such as HSBC, Bank of China, and Hang Seng Bank in 2025, which can be directly applied.

First, prove that "you are really doing business."

The core logic: Banks should first exclude "shell companies", and the response should include "business processes + quantitative data + voucher support".

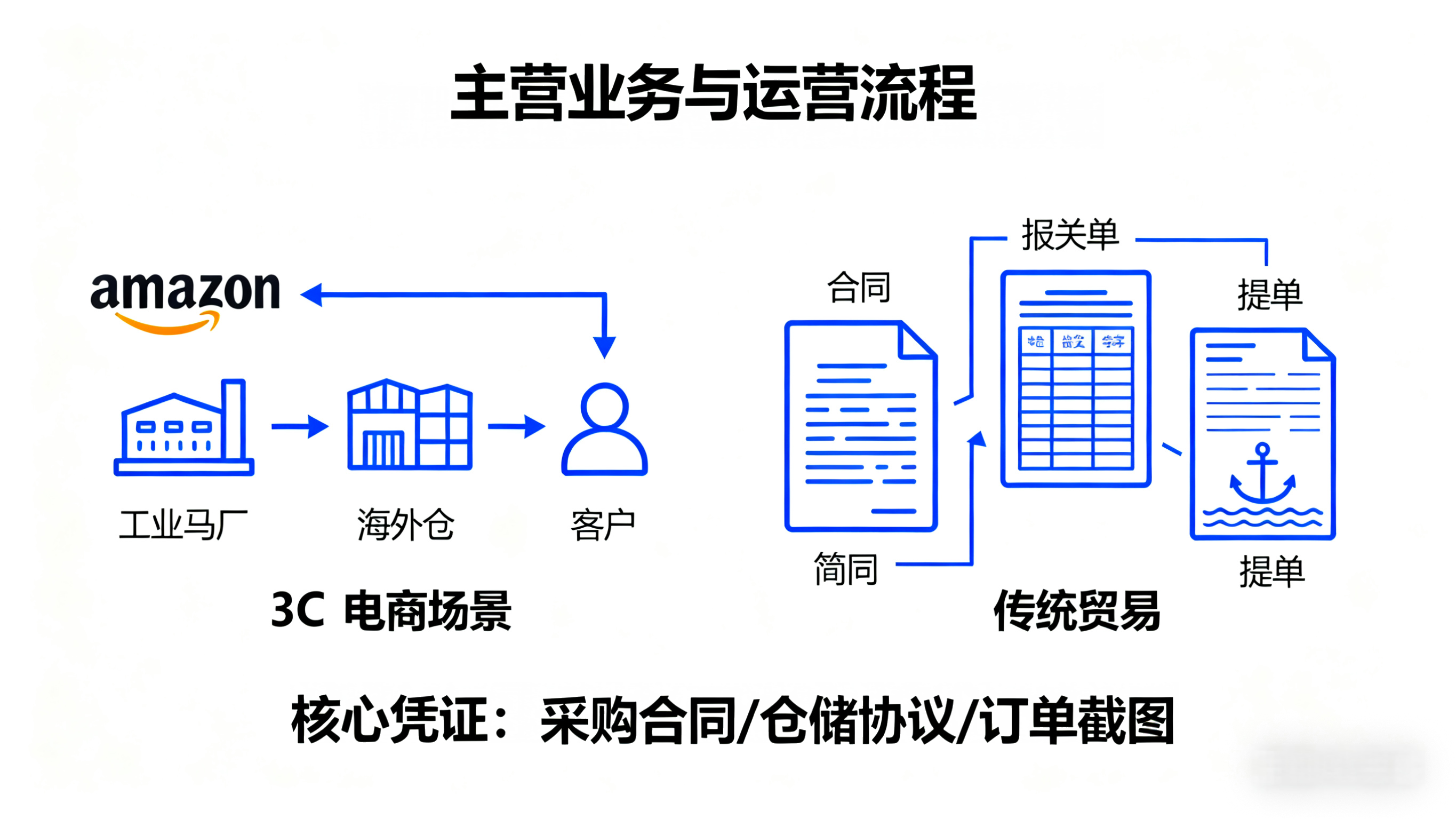

1. What is your company's main business? What is the specific operation process like?

▍ Cross-border e-commerce templates

Our company mainly engages in cross-border retail of 3C electronic products, selling through Amazon North America and its independent website. The average monthly order volume is 120 to 150, with an average monthly sales volume of approximately 800,000 Hong Kong dollars. The operation process is divided into four steps:

① Purchase from three core factories in Longhua, Shenzhen (valid purchase contracts can be provided, and the factory with the longest cooperation period has been for three years);

② The goods are sent to the overseas warehouse in Tuen Mun, Hong Kong via SF Express (with a storage agreement attached, the number can be checked).

③ Within 48 hours after the customer places an order, the goods will be dispatched from the Hong Kong warehouse. The logistics information will be uploaded to the platform (screenshots of orders placed within the last three months, including the logistics tracking number).

④ The payment will be settled monthly by the Amazon platform to the Hong Kong account. Within 7 working days after the arrival, it will be used to pay for the purchase of domestic factories (past settlement records can be provided).

Our company is engaged in the import and export of chemical polymer materials, mainly using raw materials of German brands. Our products are sold to paint manufacturers in Guangzhou and Zhejiang on the Chinese mainland. The single order value ranges from 500,000 to 1,000,000 Hong Kong dollars, and we conduct 15 to 20 transactions annually. The process is as follows:

① After signing the purchase contract with the German supplier, pay the foreign exchange from the Hong Kong account (with the supplier's bank account certificate) within 3 working days;

② After the goods arrive at the port, they will be entrusted to Sinotrans for customs clearance. The customs clearance documents include the customs declaration form and the certificate of origin (the customs declaration form number of the last six months can be checked).

③ Mainland customers shall pay RMB to the account of our mainland affiliate or HK dollar to the account of Hong Kong within 15 days after acceptance of the goods (with the business license of mainland affiliate).

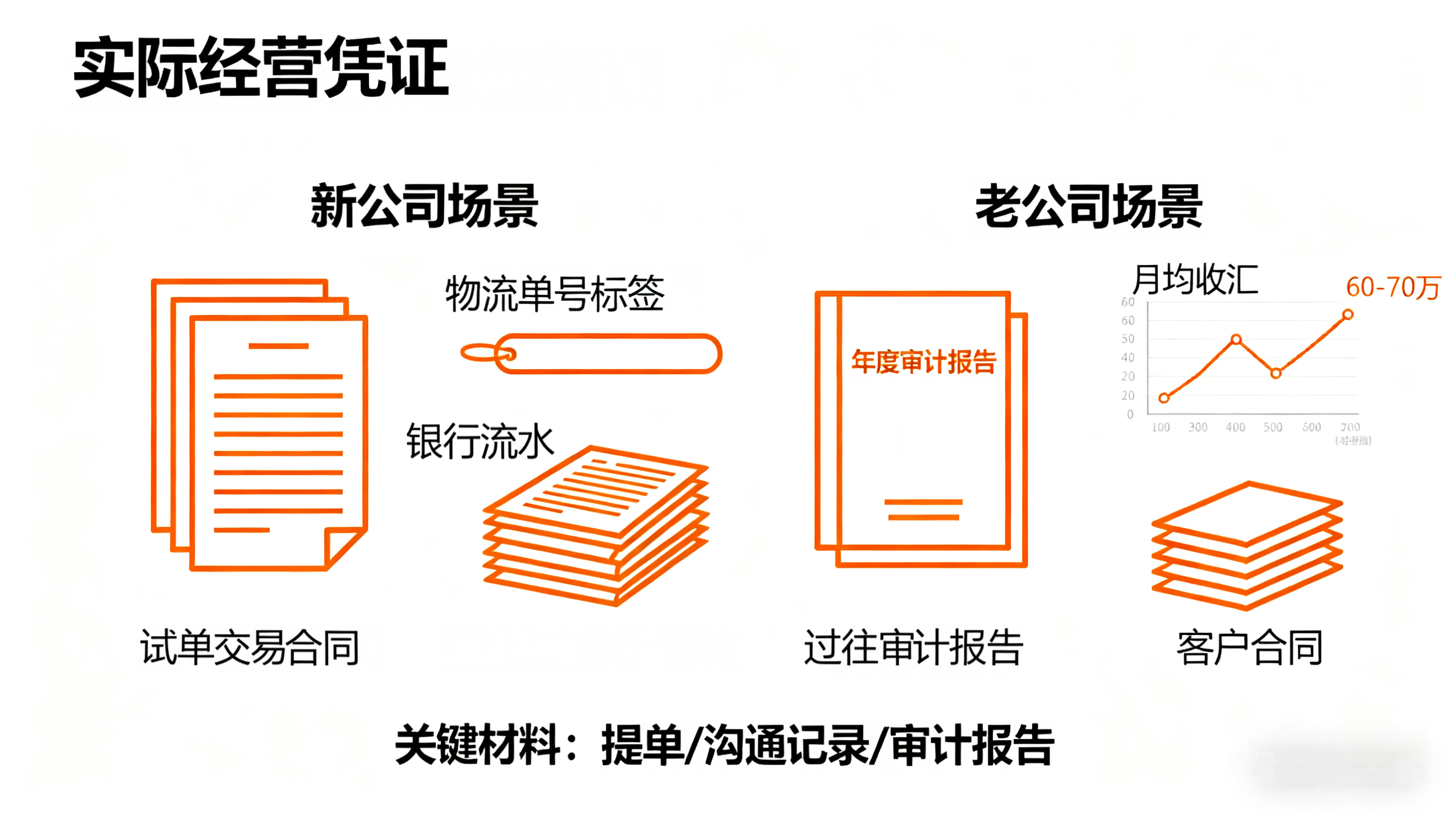

▍ Template for new companies (registered within 3-6 months)

The company was registered in March this year and has completed two written test order transactions:

The first batch is to supply 100 Bluetooth headphones to a certain trading company in the United States (with the purchase contract and proforma invoice attached, the contract amount is 85,000 Hong Kong dollars). The goods have been dispatched via DHL (the bill of lading number is XXX, and the logistics trajectory can be checked).

The second payment is to supply 50 laptops to a customer in Malaysia (with a proforma invoice amount of 120,000 Hong Kong dollars), which will be dispatched next week.

At present, we are still negotiating three intention orders (with screenshots of wechat communication records attached). It is expected that after opening an account, there will be a stable transaction of 3 to 5 times per month. Although there has been no significant transaction flow for the time being, the shareholder has been engaged in cross-border e-commerce in Shenzhen for the past three years (with the original company's audit reports for 2022-2024 attached), and the business has continuity. It is not an empty shell just entering the industry.

▍ Template for old companies (established for more than one year)

Our company was established in 2023 and achieved a revenue of 12 million Hong Kong dollars in 2024 (with the 2024 annual audit report attached, and the auditor is Hong Kong Lixin Dehao). Our core clients are three hardware wholesalers in Southeast Asia (with annual framework contracts attached, the longest cooperation period has been 18 months).

The bank statements of the affiliated companies in the Chinese mainland in the past three months show that the average monthly foreign exchange receipts are 600,000 to 700,000 Hong Kong dollars (for goods paid by customers), and the average monthly foreign exchange payments are 500,000 to 600,000 Hong Kong dollars (for purchases made to overseas suppliers). There is no situation of "only in but no out" or "large amounts of idle". All transaction contracts, invoices and bills of lading are kept in the company's archives room (screenshots of the archive directory can be provided), and can be accessed at any time.

Second, make it clear where the money comes from and where it goes.

The core logic: Banks are afraid of "unknown funds", and the response should include the banner of "proportion of funds + type of vouchers + large-scale contingency plan"3. Where do the account funds mainly come from? Could you provide proof of the source of funds?

▍ Business revenue as the main template

90% of the account funds come from overseas customers' payment for goods: for example, for American customers, the payment for the previous month's orders is settled on the 15th of each month (the payment slips of customers in the nearby three months are marked with the corresponding order number for each transaction), and for Southeast Asian customers, a 30% deposit plus 70% balance is paid according to the shipping progress (with the deposit transfer record attached).

The remaining 10% is the operating capital temporarily supplemented by the shareholders (with a handwritten capital contribution statement from the shareholders, clearly stating that it is an "interest-free loan and no repayment is required"). The shareholders' funds come from their salary income in the mainland and rental income from real estate (can provide bank statements in the mainland for the past year, with no abnormal single transaction exceeding 500,000 Hong Kong dollars).

All income can correspond to the complete chain of "contract + delivery note + payment voucher", with no anonymous remittance or collection on behalf.

The initial funds for account opening mainly consist of shareholder capital injection, amounting to 2 million Hong Kong dollars (with the transfer slip of the shareholder's mainland bank card, noted as "Investment funds of Hong Kong company"). This sum of money is planned to be used in two installments:

① HK $1.5 million was paid to the German supplier to purchase the first batch of chemical raw materials (the purchase contract has been signed, contract No. DE202506);

② HK $500,000 will be set aside as a local operation reserve fund in Hong Kong (for covering secretarial fees, auditing fees, etc.);

The subsequent funds will come from the customers' payment. We have confirmed with two existing customers that within one month after opening the account, 120,000 Hong Kong dollars (for US customers) and 180,000 Hong Kong dollars (for Malaysian customers) will be paid (with the customers' email confirmation records attached). The average monthly recovery is expected to be 500,000 to 600,000 Hong Kong dollars.

4. What are the main uses of the account funds? Will it involve large transfers?

▍ General-purpose template

The account funds are mainly divided into three types of expenditures, all of which have clear purposes:

① Payment of overseas suppliers: Among the 5 cooperating suppliers, the maximum single payment is 800,000 Hong Kong dollars (quarterly purchase payment of BASF in Germany), and the payment cycle is fixed on the 20th of each month (with the list of suppliers and payment plan attached).

② Pay local fees in Hong Kong: The secretary service fee (approximately HK $8,000 per month) is paid from the 1st to the 5th of each month, and the audit fee is paid in March each year (HK $32,000 was paid last year, with the audit invoice attached).

③ Cross-border salary payment: Only 3 local Hong Kong employees (responsible for overseas warehouse management) receive their salaries on the 10th of each month, with an average of HK $25,000 per person (with employment contracts and copies of Hong Kong identity cards attached).

In the event of a large payment exceeding 1 million Hong Kong dollars in a single transaction, we will contact the bank's customer manager three working days in advance, and simultaneously provide the corresponding purchase contract and the business license of the supplier (overseas customers need to provide the registration certificate), and cooperate with the bank for background verification.

▍ Special-purpose templates

Daily expenses are mainly small purchase funds (each transaction ranging from 200,000 to 500,000 Hong Kong dollars), and there are 2 to 3 large expenditures each year.

① Pay the overseas exhibition membership fee every April: For instance, in 2024, 280,000 Hong Kong dollars were paid to attend the Hannover Messe in Germany (with the exhibition contract and payment invoice attached), and in 2025, it is planned to participate in the Las Vegas Electronics Show in the United States (an intention agreement has been signed, with a budget of 320,000 Hong Kong dollars).

② Equipment purchase payment every two years: The next plan is to pay 2.6 million Hong Kong dollars to a certain Japanese equipment manufacturer in September this year to purchase a production line (with equipment quotation sheet and technical agreement attached).

Before making such large expenditures, we will proactively submit a "transaction background statement" to the bank, along with a complete set of supporting documents, to prevent the bank from "suddenly seeing the large transfer" and triggering risk control.

Third, prove "compliance is your cooperation enterprise"

The core logic: Banks are afraid of "associating with high-risk entities", and their responses should include "regional distribution + verification methods + compliance commitments".

5. What regions/types of enterprises are the counterparties? How to verify identity?

▍ Multi-region opponent template

The counterparties are divided into three regions, all of which are legitimate enterprises:

① Europe and America (accounting for 60%) : Mainly trading companies from the United States and Germany. Before cooperation, the other party will be required to provide the company registration certificate and the audit report of the past year (American customers need to provide an additional EIN tax number proof, which can be checked on the IRS official website).

② Southeast Asia (30%) : Wholesalers from Malaysia and Thailand need to provide a "Certificate of existence" issued by the local chamber of commerce and verify the business status through the cross-border inquiry system of the Companies Registry of Hong Kong.

③ Mainland regions (accounting for 10%) : Manufacturers in Guangzhou and Zhejiang need to provide business licenses and general taxpayer qualifications (screenshots can be checked on the 'National Enterprise Credit Information Publicity System').

All new rivals must go through a "three-level review" : checking their existence status → checking whether they are on the sanctions list → checking their past cooperation evaluations. Currently, rivals that have cooperated for more than one year account for 70%, and they can provide transaction vouchers of more than three past transactions.

6. Are there any transactions with high-risk areas (such as sanctioned countries/regions)?

▍ No high-risk trading templates

We have a clear "prohibited cooperation list" : countries/regions sanctioned by the United Nations, the Hong Kong Monetary Authority, and the US OFAC (such as Iran, North Korea, and certain areas of Russia), for which we will not cooperate (attached is the company's internal "Compliance Trading Management System", signed by the directors).

Before each new counterparty is added, the "Hong Kong Customs Sanctions List Inquiry System" is used to check twice to confirm that they are not on the sanctions list before proceeding with the cooperation.

At present, our business only covers low-risk areas in Europe, America and Southeast Asia. If we want to expand into the Middle East and South America markets in the future, we will first communicate with the bank's customer manager to confirm compliance before taking action. We will not cooperate without authorization.

▍ Templates involving sensitive but non-sanctioned regions

There are three counterparties in the United Arab Emirates (Middle East), but the UAE is not on any sanctions list, and the cooperation content is "industrial product procurement" (with a product list attached, excluding prohibited categories such as oil and weapons). There are additional requirements for cooperating with Middle Eastern clients:

① The other party needs to provide a "Statement of No Sanctions Association", which should be scanned and archived with the official seal.

② The payment method is only "letter of credit" (with a sample of letter of credit attached), and "third-party payment on behalf" is not accepted.

③ Each transaction must be marked with "Transaction Purpose" in the 'SWIFT Message' to ensure the traceability of the fund chain.

We have been cooperating with a client from the United Arab Emirates for two years without any compliance issues. The bank can check the past transaction records.

Four. Convince the bank that "you will continue to comply"

The core logic: Banks are afraid of "subsequent loss of control", and their responses should include "emergency procedures + information disclosure + long-term measures".

7. In the event of a "large anonymous abnormal transaction", how will your company handle it?

We have formulated the "Abnormal Transaction Handling Process", which is divided into four steps:

① Immediate freezing: After receiving unknown funds, contact the bank's customer manager within 24 hours, explain that "the source of the funds is unknown", and apply for the temporary freezing of the funds without misappropriation.

② Verify the source: Ask the bank to assist in checking the remitter's information (such as SWIFT code, remitter's name), and at the same time proactively contact potential customers to confirm whether it is a "mistaken transfer" or a "advance payment from a new customer".

③ Handle the situation differently: If it is a mistaken remittance, we will assist in the refund within 3 working days (with a refund application and bank receipt attached). If it is a new customer's advance payment, check the qualifications according to the "New counterparty Due diligence Process", and sign the contract only after confirming compliance.

④ Archiving and filing: The entire processing procedure will record "time, communication content, and supporting documents" to form an "Abnormal Transaction Handling Report". If the bank needs to check later, it can be provided at any time without any concealment.

8. Who is the beneficial owner of the company? Has it been fully disclosed?

In accordance with the CRS 'Penetration Disclosure' requirement, the beneficial owners of our company are two natural persons:

① Zhang XX: Holds 80% of the shares, serves as an executive director, responsible for the company's business decisions (with an equity structure diagram attached, filed with the industry and commerce authorities), and can provide ID card and water and electricity bills for the past three months (to prove the authenticity of the address).

② Li XX: Holds 20% of the shares, is only a financial investor, and does not participate in daily management (attach a "Statement of Non-Participation in Business Operations" with signature), and also provide ID card and proof of address.

Neither of them has permanent residence rights abroad. They have filled out the "Beneficial Owner Declaration Form" as required by the bank, and all the information is true and unconcealed.

If there is any equity change in the future (such as the transfer of shares), the bank will be notified within 15 working days, and the information of the beneficial owner will be updated without delay.

9. Can you cooperate with the bank to provide transaction proof documents (such as invoices, bills of lading)?

Sure. We have dedicated personnel in charge of "transaction file management"

① Daily transactions: For each order, the contract, invoice, bill of lading, and logistics note are all saved in electronic form (using encrypted cloud disk) and paper form (archived at the Hong Kong office). If the bank wants to check them, they can be submitted within 3 working days.

② Large transactions (over 500,000 Hong Kong dollars) : Prepare an additional "Customer Acceptance Form" and "Supplier Shipping Confirmation Letter" to prove that the transaction has actually occurred.

③ Annual Verification: After the audit in March each year, a copy of the audit report will be proactively sent to the bank to cooperate in conducting the "annual compliance Review".

We will never refuse to provide on the grounds of "lost documents" or "business secrets", after all, compliance is the foundation of cooperation.

10. Is your company familiar with the anti-money laundering regulations in Hong Kong? How to ensure compliant operation?

We have conducted systematic studies: Directors and financial personnel have all participated in the Anti-Money Laundering Ordinance training organized by the Hong Kong Institute of Certified Public Accountants (with training certificates attached), focusing on the requirements of "Beneficial Owner penetration disclosure" and "high-risk area verification" in the 2025 new regulations. Daily compliance relies on three measures:

① On the 1st of each month: Check whether all counterparties are on the "New Sanctions List";

② At the end of each quarter: Sort out the account transaction records, mark "large/high frequency/cross-regional" transactions, and write the "Transaction Record Analysis Report".

③ Every year, have a "compliance check-up" with a licensed secretarial company (we cooperate with Hong Kong XX Secretarial Company, which has a TCSP license and the license number can be checked), and promptly adjust non-compliant procedures.

If there are any updates to the regulations in the future, we will organize learning sessions immediately and adjust our internal processes to ensure that we always meet the requirements of banks and the Hong Kong Monetary Authority.

In 2025, when opening an account for a Hong Kong company, the "anti-Money laundering Q&A" is not about "going through the process", but rather the key for banks to determine "whether you are trustworthy" - vague answers = empty shell risks, and promises without evidence = compliance risks.

It is recommended that everyone do two things before opening an account

1. According to the above template, fill in the "Personalized Response" based on your own business. For example, replace "3C products" with your main products and "800,000 Hong Kong dollars" with your actual transaction volume.

2. Prepare the "Response Supporting Materials package" in advance: It should include the contracts, bills of lading, payment slips of 3 to 5 transactions, shareholder capital contribution certificates, and counterparty qualification documents to avoid "empty words without evidence" during the response.

If you are unsure how to match your business to respond or need assistance in verifying the compliance of your counterparty, you can contact the number below or add wechat. As a licensed Hong Kong secretarial company, we can provide the "pre-review of account opening materials + response simulation" service to help you reduce account opening delays caused by anti-money laundering Q&A.